Morning Note - 17 January 2025

Below is our quick take on market momentum across key assets, recent economic developments, and what to watch for in today’s data releases.

1. Asset Momentum & Intermarket Dynamics

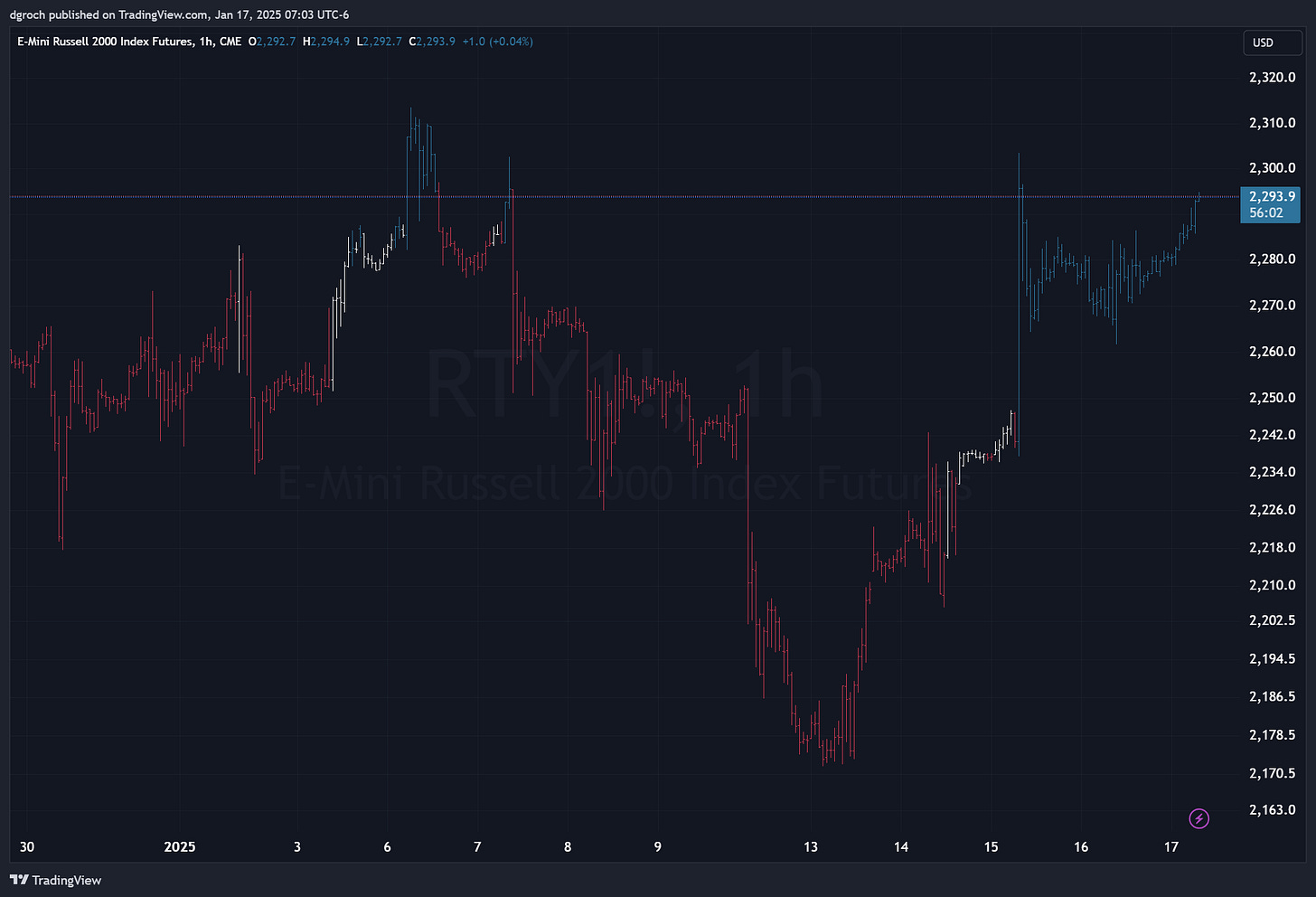

Equities (S&P 500, Nasdaq, Dow, Russell 2000)

Short-Term (15m, 60m): All four major US indices (S&P 500, Nasdaq, Dow, Russell 2000) retain a broadly bullish posture, with fresh “up” flips over the past few sessions. This short-term strength aligns with positive daily/longer-term momentum that has been in place for several months.

Medium-Term (240m): Similarly positive across the S&P 500, Nasdaq, Dow, and Russell, reinforcing the view that dips are being bought and the broader uptrend remains intact.

Daily: The S&P 500 and Dow show prolonged “up” momentum since late 2022. Nasdaq joined this uptrend last January, and Russell 2000 has been intermittently catching up, albeit with slightly more volatility.

Implication: Equities remain underpinned by strong multi-timeframe momentum. Any near-term pullback may be viewed as consolidation within an ongoing uptrend.

Treasuries (2-year, 10-year, 30-year Notes/Bonds)

Short-Term (15m, 60m): Momentum has recently turned up in the very short term (i.e., bond prices rising, yields easing).

Medium-Term (240m): Still showing mixed or down signals depending on the specific tenor (particularly 10-year and 30-year).

Daily: The longer-term trend remains down (i.e., yields higher) since October, suggesting potential caution if short-term rallies stall.

Implication: We see a short-term bounce in bond prices, but the broader, longer-term direction for yields remains upward. Watch for any follow-through that might signal a deeper correction to yields.

Commodities

Gold (GC): Firmly up on 15m, 60m, 240m, and daily timeframes. Momentum has been consistently strong since last year, and near-term dips have reversed quickly.

Crude Oil (CL):

Longer-term (daily, 240m): Recently flipped up (end of December) and has maintained that direction.

Short-term (15m): Flips have been choppy, showing mixed signals; momentum is slightly negative in the last day. However, the general medium-term trend remains to the upside.

Copper (HG): Exhibits a strong up bias on the 60m and 240m charts since earlier this month, which aligns with improving industrial sentiment on the back of stronger Chinese data.

Implication: Precious metals (especially gold) continue to benefit from steady demand. Crude oil’s near-term volatility has not interrupted its broader uptrend. Industrial metals like copper appear supported by positive Chinese macro data.

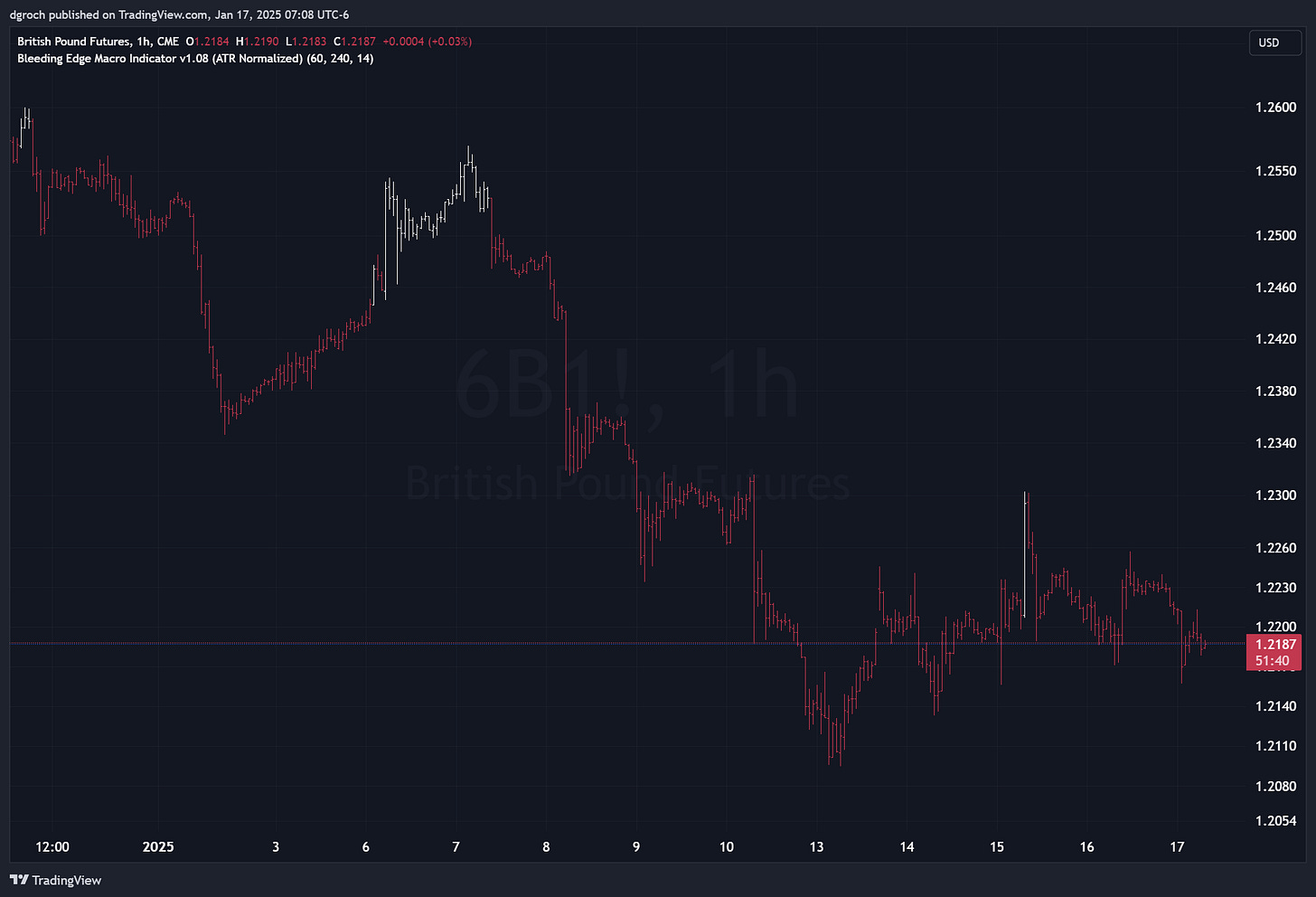

FX (EUR, GBP, AUD, JPY)

EUR/USD (6E): Primarily down across most timeframes, including new short-term down flips. This aligns with the longer-term daily downtrend that started in early October.

GBP/USD (6B): Also leaning down across 15m, 60m, and 240m, suggesting the pound remains under pressure.

AUD/USD (6A): Continues its downtrend on both short and medium-term charts; the daily flip in October also confirmed a heavier bias.

USD/JPY (6J): Short-term charts show quick flips between up and down. The 240m timeframe is “mixed,” while on the daily chart, the yen has broadly weakened since December.

Implication: The US Dollar shows renewed firmness, pressuring EUR, GBP, and AUD. JPY remains choppy in the short term but is generally weaker over the longer horizon.

Bitcoin (BTC)

Short-Term (15m, 60m): Recent flips back to up, showing a quick bounce from minor dips.

Medium-Term (240m): Momentum has been up since September; consistent pullbacks are met with renewed buying.

Daily: The broader uptrend from last year remains in place.

Implication: BTC’s resilience continues. Short-term choppiness has not derailed the multi-month uptrend.

2. Recent & Upcoming Economic Data

Released in the Past 24 Hours

UK GDP (NOV)

MoM: 0.1% vs. -0.1% previous (slightly better than prior) but below 0.2% consensus.

YoY: 1.0% vs. 1.1% previous and 1.3% expected (marginal slowdown).

US Retail Sales (DEC): 0.4% vs. 0.8% prior and 0.6% expected (a moderate deceleration).

China GDP (Q4 YoY): 5.4% vs. 4.6% prior, beating 5.0% expected.

China Industrial Production (DEC): 6.2% vs. 5.4% prior, above 5.4% forecast.

China Retail Sales (DEC): 3.7% vs. 3.0% prior, topping 3.5% expected.

UK Retail Sales (DEC): -0.3% vs. 0.1% prior and 0.4% expected (weak outcome).

Comment: The standout news is China’s stronger-than-expected growth, fueling optimism around global industrial demand. Meanwhile, UK data remains mixed: better GDP headline but weaker retail activity. US retail sales moderated slightly in December, suggesting holiday season strength was somewhat lower than the market had anticipated.

Scheduled for Today

US Building Permits (Prel DEC): Expected 1.46M (vs. 1.493M previous).

US Housing Starts (DEC): Expected 1.32M (vs. 1.289M previous).

What to Watch: Housing permits and starts data will provide fresh insight into the US property market. A downside surprise might weigh on cyclical sentiment, while an upside surprise could support the broader growth outlook.

Bottom Line

Equities: Retain strong upward momentum across multiple time horizons. Short-term dips are being quickly reversed.

Treasuries: A short-term price rally (lower yields) contrasts with longer-term yield uptrends. This tug-of-war may continue if economic data surprises.

Commodities: Gold and Copper remain solidly bid; Oil’s short-term volatility should not detract from its uptrend.

FX: The Dollar remains supported; EUR, GBP, and AUD remain pressured on multiple timeframes.

Crypto: BTC maintains its multi-month climb despite near-term fluctuations.

—End of Briefing—