Equities remain in the driver’s seat. The S&P, Nasdaq, Dow, and Russell 2000 all show firm upside momentum on shorter timeframes, reinforcing what’s been an extended bullish tilt on the daily charts. Risk appetite is strong, but watch yields: Treasuries across the curve (ZT, ZN, ZB) have flipped or remained in negative momentum, signaling rising rates and pressuring bond prices. We maintain the view that it will be the bond market, perhaps with the assistance of a hawkish fed, that halts the mania in risk.

Commodities present a mixed picture. Crude’s short-term momentum turned downward again despite still being in an uptrend on higher timeframes. Trump has made his intent clear post inauguration; “drill baby drill”. Reading between the lines, perhaps initial contact with Putin hasn’t yielded the results Trump had expected. He may be preparing his arsenal to combat Russia directly, and pressuring crude prices with US supply is one arrow in his quiver.

Gold stands out with consistently positive momentum across multiple horizons, hinting that “safe haven” demand hasn’t faded even in a risk-on environment.

FX is similarly two-toned. The Aussie (6A) and euro (6E) show an intraday lift, yet their daily momentum trends remain negative overall. Yen (6J) continues to soften, flipping to a fresh negative on short-term charts. It appears the BOJ inflation data and rate hike (released/announced tomorrow) was entirely priced in.

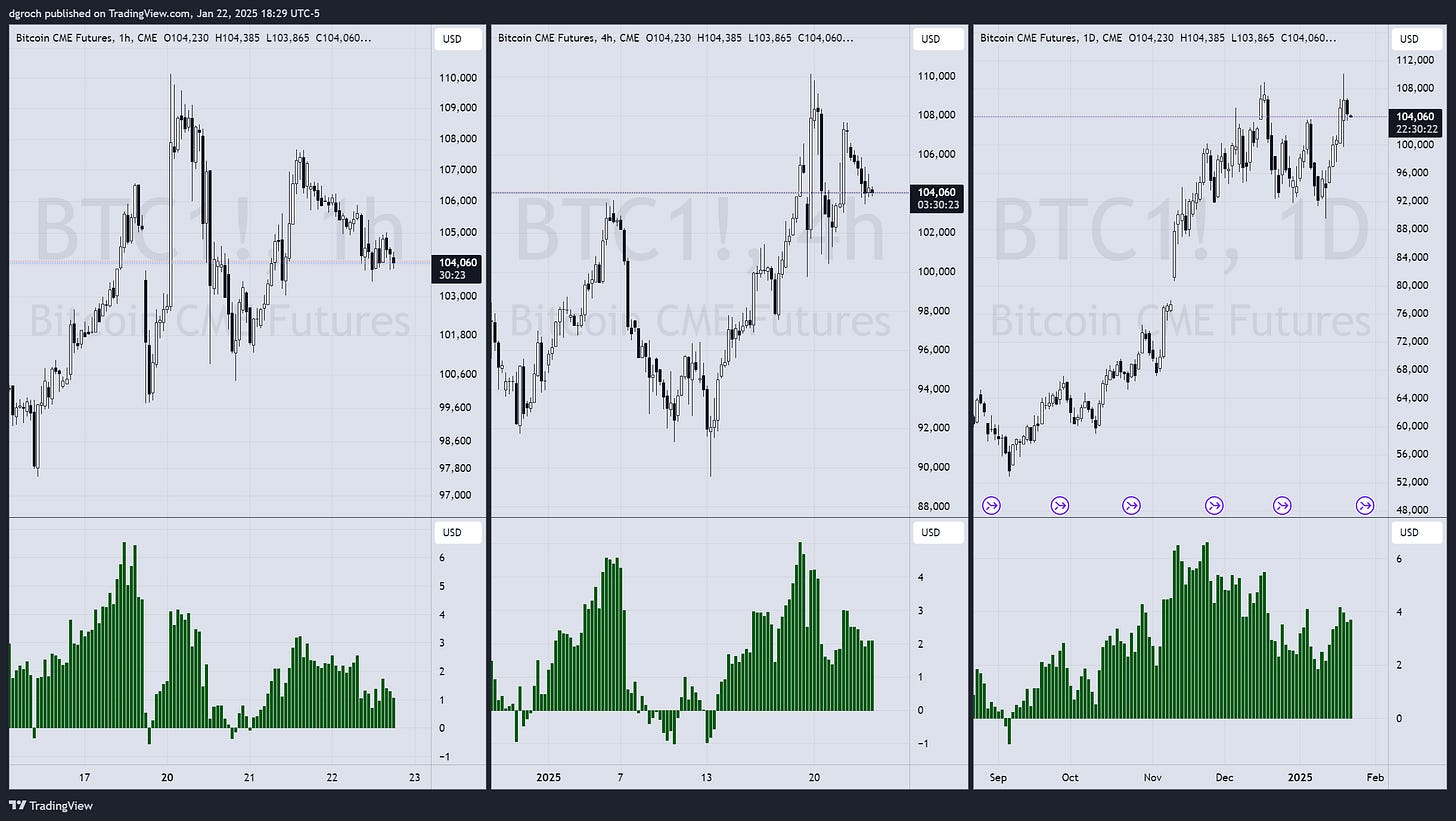

Meanwhile, bitcoin’s longer-term bullish pattern remains intact despite a minor intraday fade. Overall, the story is one of robust equity sentiment wrestling with rising yields, as commodity and currency moves scramble around the edges of a still largely risk-on narrative.

Recent Trades

Yesterday we put on a 5,700 / 5,200 Bear Put Spread in E-Mini S&P Futures. With expiry on 31 March this was a cheap insurance (22 handles) and covers many catalysts over the coming months.

We sold naked calls in EUR futures (6E). This position is in part a hedge for our long AUD futures (6A) position which was initiated due to divergence with moves in the industrial metals market. We expect US inflation, growth and therefore rates to continue to be incrementally hotter than Europe.

We sold a Bear Call Spread in 30Y Bonds yesterday.

And earlier this week, when the Canadian Dollar (6C) was up almost 100 bp, we initiated a medium term short position. Trump has threatened 25% tariffs on Canada and Mexico from 1 February. The Canadian economy is already faltering under the weight of excessive consumer debt burdens, an inflated property market and lackluster growth. Tariffs are salt in those already festering wounds; therefore, we expect BOC to be incrementally weaker than global peers.

Key Takeaways

We are inside a mini mania but feverish risk appetite will not fold under its own weight.

Financial conditions are as tight as a clowns shoe. It is increasingly likely either the FOMC will take away the punchbowl. Next FOMC meeting is January 28-29, 2025.

If the FOMC doesn’t take away the punchbowl, odds are the bond market will do it for them. After a tepid recent bounce, momentum is again negative on all timeframes we track: 1h, 4h and daily. And you can expect incrementally hotter date over the coming months.

We are potentially trading within a medium to longer term top for risk assets like equities. A meaningful analog is the 2021/22 topping formation which developed over 2 months between 5 November and 5 January. During that period the market reached a crescendo of ebullience before the fever broke; you remember the $300k jpegs, right?

Catalyst for installation of the 5 January 2022 top was release of December 2021 FOMC minutes which revealed plans to accelerate its timeline for raising interest rates due to high inflation and a strong labor market, and also reducing its balance sheet by offloading bonds and mortgage-backed securities.